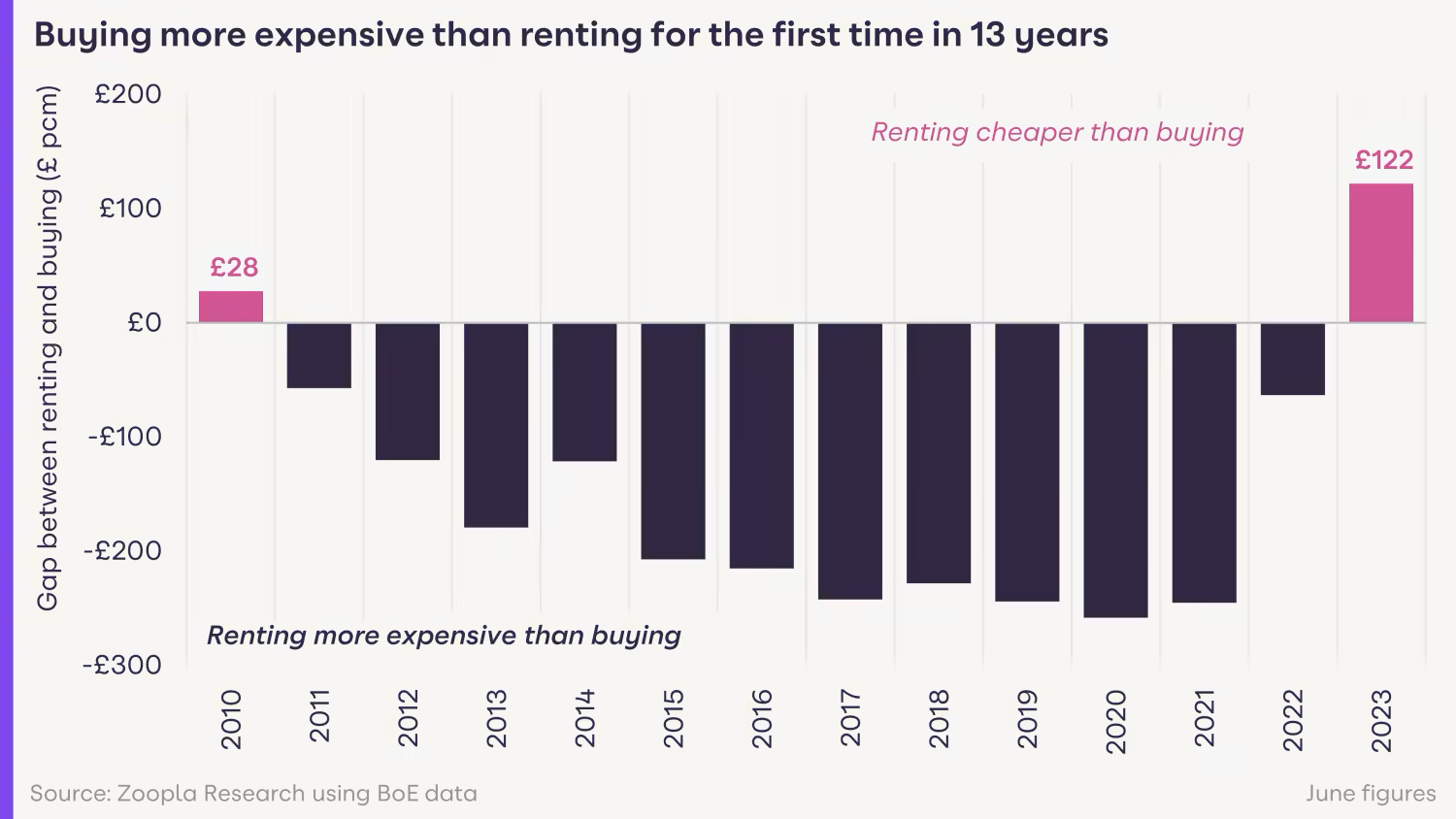

Higher mortgage rates mean that renting has become cheaper than buying a home for the first time since 2010.

Key takeaways

- The typical monthly rent is now 9.5% or £122 cheaper than the mortgage repayments for the same rental property

- Higher mortgage rates have increased mortgage costs faster than rents have been rising

- It’s still cheaper to buy than rent in regions with below-average house prices, like in the North of England and Scotland

- First time buyers in the South of England need a 31% or £42,000 deposit match their mortgage repayments to their monthly rent

For the first time in 13 years, paying rent is cheaper than repaying a mortgage for first-time buyers.

This difference in the cost of renting versus buying is front of mind for many first-time buyers, who account for 1 in 3 home sales.

70% of them are renting in the 3 years before they buy a home, and they’ve historically looked forward to paying less in monthly mortgage repayments than they do in rent.

But with mortgage rates remaining high this year, the cost of repaying a mortgage each month is now more expensive than rent on the same property.

Higher mortgage rates make renting cheaper than mortgage costs

We’ve compared the average rent to the average monthly mortgage repayment for a first-time buyer. Our analysis presumes they’re buying the property they rent with a 15% deposit on a 30-year term with a mortgage rate of 5.6%.

If you’re a first-time buyer, your monthly rent will be £122 cheaper than the mortgage repayment on the same property.

Higher mortgage rates have increased a typical first-time buyers’ mortgage repayments by a third in the last 12 months.

Meanwhile, rents have risen by a lesser 10.4% over the same period, pushing buying to become more expensive than renting.

The chart shows the difference between the average rent and monthly mortgage repayment since 2010.

Mortgage repayments were cheaper than rent for the last 13 years

Since 2010, average mortgage repayments for first-time buyers were £210 cheaper per month than renting on average.

This meant that many better-off first-time buyers could afford to buy a larger 3 bedroom - and sometimes even 4 bedroom - house, without spending any more on housing each month.

Our data matches up with this, showing that half of first-time buyers wanted to buy a three bedroom house in 2022.

This was the case up until the mini-budget fall-out last autumn, when the difference between mortgage repayments and rents shrank.

Buying is still cheaper than renting in the North of the UK

Although renting is now cheaper than buying in the UK on average, there are some regions where buying a house still works out cheaper.

There’s a clear north-south divide, as regions with lower property values are cheaper to buy than rent in - by as much as 18% per month.

In the North East of England, a first-time buyer could expect to pay 18% (or £118) less on their mortgage each month than their rent.

And in Scotland, you’d pay 17% (or £128) less on your mortgage than rent.

It’s still marginally cheaper to buy an average-priced rented home than rent in the North West, Northern Ireland, Wales and Yorkshire and the Humber.

However, if mortgage rates increase to 6%, then renting is likely to become cheaper in these regions.

Region | Average price of a rental home | Deposit (15%) | Average monthly rent | Monthly mortgage repayment | Mortgage repayment vs rent per month |

Scotland | £127,000 | £19,100 | £748 | £620 | -£128 |

North East | £109,000 | £16,300 | £649 | £531 | -£118 |

North West | £151,000 | £22,600 | £795 | £736 | -£59 |

Northern Ireland | £143,000 | £21,500 | £744 | £700 | -£44 |

Yorkshire and the Humber | £150,000 | £22,500 | £758 | £731 | -£27 |

Wales | £164,000 | £24,600 | £814 | £799 | -£15 |

West Midlands | £182,000 | £27,300 | £852 | £890 | £38 |

East Midlands | £178,000 | £26,700 | £816 | £868 | £52 |

South West | £243,000 | £36,400 | £1,016 | £1,184 | £168 |

East of England | £267,000 | £40,000 | £1,111 | £1,301 | £190 |

South East | £301,000 | £45,200 | £1,254 | £1,469 | £215 |

London | £522,000 | £78,300 | £2,053 | £2,546 | £493 |

UK | £263,000 | £39,500 | £1,163 | £1,285 | £122 |

Zoopla, August 2023

The table shows the cost of mortgage repayments versus monthly rent for first-time buyers using a 15% deposit, 30-year mortgage term and 5.6% mortgage rate.

Why has buying a home in the Midlands become more expensive?

Buying an average-priced rental property in the Midlands became more expensive than renting it when mortgage rates exceeded 5% at the end of 2022.

Our research shows that you’d need to add £9,000 to your deposit to make your mortgage repayments closer to your rental payments.

How can I make mortgage repayments cheaper than renting in the South of England?

Increase the size of your deposit

It’s a lot easier said than done, but having a bigger deposit when you buy your first home will usually reduce your monthly mortgage repayments.

By increasing your equity, you’ll borrow less from the mortgage provider and you’ll therefore pay less interest.

It may also mean that you’re offered a cheaper interest rate as you have a smaller loan-to-value (LTV) ratio.

Understanding loan-to-value ratios

If you can add £5,000 to your deposit, you reduce your LTV by 2%. This brings your monthly mortgage repayment down by 2.2%. (Like the rest of our analysis, this is assuming you’re buying an average-priced rental property.)

The benefit of a bigger deposit will be greater in the regions where buying has recently become more expensive than renting, like in the Midlands.

However, you’ll need to add much more to your deposit in the South of England to keep your monthly mortgage repayments in line with your rent.

Renting is at least £160 cheaper than paying a mortgage each month in all southern regions. That gap reaches £490 in London.

To match mortgage payments to the average rent in London, you’d need to increase your deposit to 31% of the property value - equivalent to £164,000.

In other southern regions, a 31% deposit to match your mortgage payment to your rent ranges from £66,000 in the South West to £83,000 in the South East.

How to save for a deposit

Falling mortgage rates might ease pressure on first-time buyers searching for extra equity. Mortgage rates falling back to 5% mean mortgage payments would end up matching average rent with a 23% deposit in southern regions.

How else could I bring down my monthly mortgage repayments?

Buddy up with another buyer

Buddying up with another buyer (like a partner, family member or friend) can reduce your mortgage costs.

With both of your savings added together, you’ll increase your deposit and reduce your LTV. This may give you access to better mortgage rates, and you’ll pay less interest overall.

Of course, you need to think about whether it’s right for you to buy a house together

Consider changing your home requirements

It can be really difficult to find extra money for a deposit. If you’re struggling, you could reconsider what you need from your first home.

Maybe you could go for a smaller property, or a terraced home or flat instead of a semi- or detached house. Searching further afield and outside of cities may also surface more affordable properties.

Source: Zoopla

By

By

Share this with

Email

Facebook

Messenger

Twitter

Pinterest

LinkedIn

Copy this link